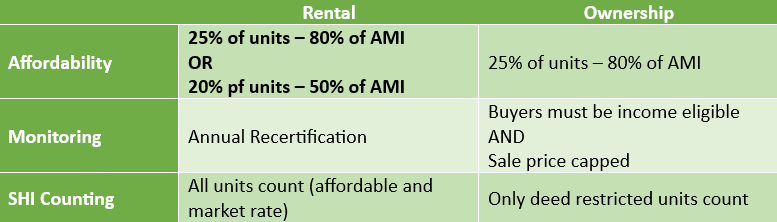

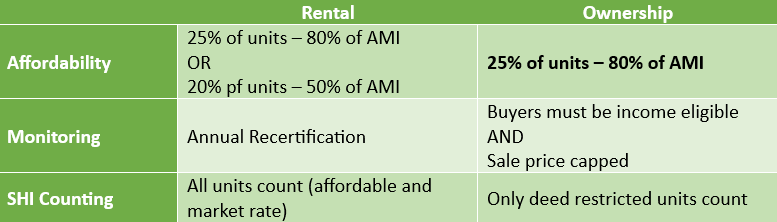

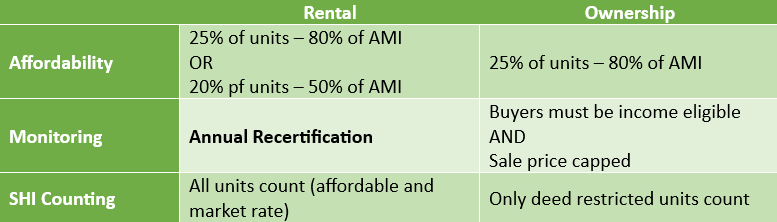

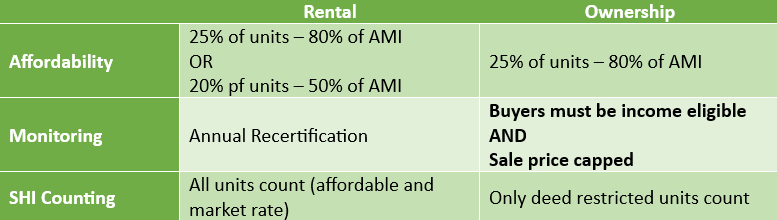

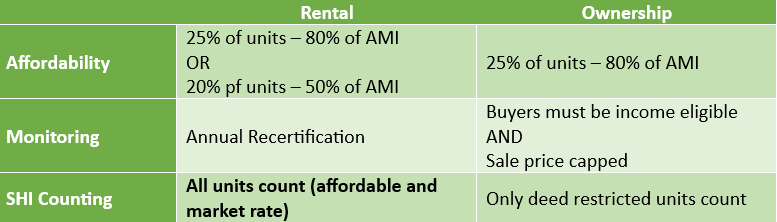

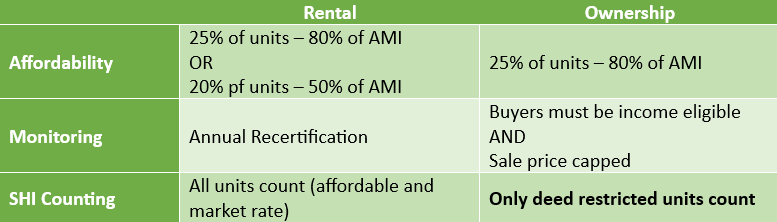

At least 25% of the units must be restricted to households earning at or below 80% of AMI OR at least 20% of the units to households earning at or below 50% of AMI. This option provides flexibility for developers to target different income tiers within the affordable spectrum. Rents for these units are set to be affordable for the target income levels, typically including a utility allowance.

At least 25% of the units must be sold to households earning at or below 80% of AMI. However, the maximum allowable sales price for these units is usually set to be affordable for a household at 70% of AMI. This "window of affordability" is designed to ensure that the units are truly attainable for a broader range of buyers, even if their income is slightly below the 80% threshold.

Rental affordable units usually undergo annual income recertification for tenants to ensure they still meet the income requirements.

Subject to a deed restriction that applies to all future sales of that unit. The resale price is capped by a formula outlined in the deed rider, and the unit must be sold to another income-eligible buyer. Ownership units generally do not require annual income recertification of the owner after the initial purchase; the affordability is maintained through the resale controls.

All units in the project (both affordable and market-rate) can typically be counted towards a community's 10% Subsidized Housing Inventory (SHI), provided the project meets the affordability threshold (20% at 50% AMI or 25% at 80% AMI). This makes rental projects a very efficient way for communities to increase their SHI.

For homeownership developments, only the deed-restricted affordable units are counted towards the community's SHI. This means that while crucial for ownership opportunities, they contribute fewer units to the overall SHI calculation compared to a rental project of the same size.